This well executed video is actually an advertisement for the Som Sabadell, banking group in Spain.

The natural evolution of marketing is like this: a thought, a concept, a plan, execution, implementation, and consultation after the fact. The problem that most companies suffer from is they go from thought to execution without any concept or plan. Then they rely on consultants to tell them what they already know. Outside validation is what's important. If two people agree, that's collaboration. If three people agree, it must be a trend. Or is it?

Cloud-based data can be interesting...

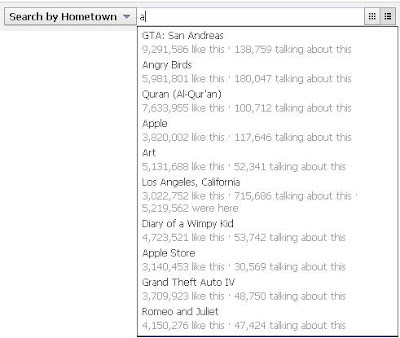

...especially when it's not mapped or indexed properly. Surely, someone wise in the ways of data at Facebook would have seen this one coming long before the feature got implemented. To get to this drop-down list, pick one of your friends that has a viewable Friends list, and then change the category selector to filter the list. It doesn't matter what category you choose (other than by Name), all other categories will result in the same un-targeted category results.

Example. A search by "hometown" yields these sample selections, where the match is based on any letter match, say "*a*" versus "a*". It makes a big world of difference to start the match based on criteria that comes after the first letter that a user keys in than what it is today, a match based on any placement in a phrase or word. See image below:

Example. A search by "hometown" yields these sample selections, where the match is based on any letter match, say "*a*" versus "a*". It makes a big world of difference to start the match based on criteria that comes after the first letter that a user keys in than what it is today, a match based on any placement in a phrase or word. See image below:

Data Inflation

It seems as though every time a population number is cited for a social media site, the number of users keeps increasing. I'll just go ahead and say it since no one else will. As long as user-to-user incentives exist, there will always be enough fake user accounts to take advantage of what are supposed to be exclusive benefits. What are we talking about here?

500 million user accounts on Twitter (as of April 2012), with 42 million unique visitors per month according to Compete.com (May 2012). It makes you wonder who these users really are. They are more likely to be companies with multiple locations, brand groups or products that appear on the site as multiple "user" accounts. If we just focus on the U.S., it's a mere 107 million users. Let's assume for a moment that the average marketer or social promoter has at least 3 "user" accounts (a personal acct, a main company acct, and a brand account). Take the 107 million accounts and divide that by 3. That's a safe bet that there are only 35 million, at best, Twitter users in the U.S.

Thinking about targeting Facebook users instead? The figure of 901 million users frequently cited by news and marketing publications represents a global figure, with only 155 million (143 million aged 18-65) being in the U.S. There are some ad targeting issues with Facebook which I'll address in another post. Is it plausible that Zynga has over 250 million active users on its popular Facebook games? Possibly, but depends on how an active user is defined. Are we talking unique users accessing a multitude of Zynga games; or counting unique user accounts per game? Here's some hefty division to pare this down to a more realistic number. This is where in-game incentives get silly. Take Cityville's top population number, 40 million, and divide that by 5; a rough estimate of actual number of users or the number of "friends" you need to get by on a daily city/farm/mafia maintenance for your character. If people are willing to write and install browser scripts to autoplay a social media-based game, anything is possible within the Facebook universe. Cityville may only have 8 million real users by conservative estimate. Still, Zynga's $900 million revenues from advertising, in-game branded product placement, and sales of virtual goods and fake currency is pretty damn impressive for casual social gaming.

Data inflation is not such a big deal on business networking site LinkedIn since a business person can really only respond to one unique offer per set of user credentials. Even with its 150 million plus global userbase and more than 40 million users in the US, it's safe to say that you could take that number and divide it by two. It'd be a fair representation of an actual userbase, given company churn and users who forget that they can assign more than one email account to their LinkedIn account. Even without the divide, 40 million business users seems low for the US audience.

Why does any of this matter? Because it's a damn freakin' problem for social media marketers, that's why.

500 million user accounts on Twitter (as of April 2012), with 42 million unique visitors per month according to Compete.com (May 2012). It makes you wonder who these users really are. They are more likely to be companies with multiple locations, brand groups or products that appear on the site as multiple "user" accounts. If we just focus on the U.S., it's a mere 107 million users. Let's assume for a moment that the average marketer or social promoter has at least 3 "user" accounts (a personal acct, a main company acct, and a brand account). Take the 107 million accounts and divide that by 3. That's a safe bet that there are only 35 million, at best, Twitter users in the U.S.

Thinking about targeting Facebook users instead? The figure of 901 million users frequently cited by news and marketing publications represents a global figure, with only 155 million (143 million aged 18-65) being in the U.S. There are some ad targeting issues with Facebook which I'll address in another post. Is it plausible that Zynga has over 250 million active users on its popular Facebook games? Possibly, but depends on how an active user is defined. Are we talking unique users accessing a multitude of Zynga games; or counting unique user accounts per game? Here's some hefty division to pare this down to a more realistic number. This is where in-game incentives get silly. Take Cityville's top population number, 40 million, and divide that by 5; a rough estimate of actual number of users or the number of "friends" you need to get by on a daily city/farm/mafia maintenance for your character. If people are willing to write and install browser scripts to autoplay a social media-based game, anything is possible within the Facebook universe. Cityville may only have 8 million real users by conservative estimate. Still, Zynga's $900 million revenues from advertising, in-game branded product placement, and sales of virtual goods and fake currency is pretty damn impressive for casual social gaming.

Data inflation is not such a big deal on business networking site LinkedIn since a business person can really only respond to one unique offer per set of user credentials. Even with its 150 million plus global userbase and more than 40 million users in the US, it's safe to say that you could take that number and divide it by two. It'd be a fair representation of an actual userbase, given company churn and users who forget that they can assign more than one email account to their LinkedIn account. Even without the divide, 40 million business users seems low for the US audience.

Why does any of this matter? Because it's a damn freakin' problem for social media marketers, that's why.

Subscribe to:

Comments (Atom)